How Feie Calculator can Save You Time, Stress, and Money.

Table of ContentsThe Of Feie CalculatorThe Best Strategy To Use For Feie CalculatorGetting My Feie Calculator To WorkThe Of Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Talking AboutFeie Calculator - TruthsThe Main Principles Of Feie Calculator

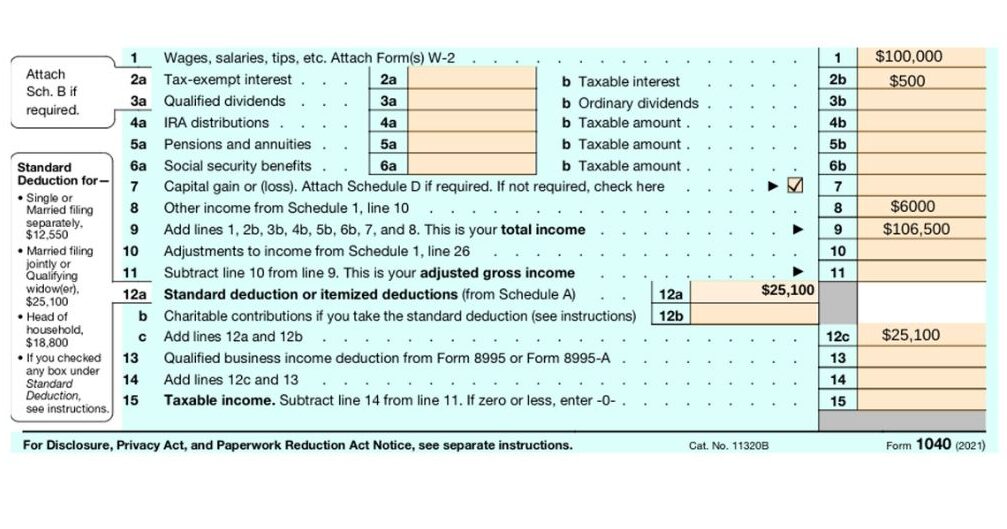

If he 'd frequently taken a trip, he would certainly rather complete Part III, providing the 12-month duration he satisfied the Physical Existence Examination and his travel history - Digital Nomad. Action 3: Coverage Foreign Income (Part IV): Mark earned 4,500 each month (54,000 yearly). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its value is likewise included.Mark calculates the exchange price (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Given that he resided in Germany all year, the portion of time he resided abroad throughout the tax is 100% and he gets in $59,400 as his FEIE. Mark reports complete wages on his Type 1040 and gets in the FEIE as an adverse quantity on Schedule 1, Line 8d, reducing his taxable income.

Choosing the FEIE when it's not the most effective option: The FEIE might not be perfect if you have a high unearned earnings, earn even more than the exclusion limitation, or reside in a high-tax nation where the Foreign Tax Debt (FTC) might be more valuable. The Foreign Tax Credit (FTC) is a tax decrease approach frequently used along with the FEIE.

The Definitive Guide for Feie Calculator

deportees to offset their U.S. tax debt with international revenue taxes paid on a dollar-for-dollar decrease basis. This implies that in high-tax countries, the FTC can often eliminate united state tax obligation debt completely. The FTC has limitations on qualified tax obligations and the maximum claim quantity: Eligible tax obligations: Only revenue tax obligations (or taxes in lieu of income tax obligations) paid to foreign federal governments are eligible (Bona Fide Residency Test for FEIE).

tax obligation responsibility on your foreign earnings. If the international taxes you paid exceed this limitation, the excess international tax obligation can usually be continued for approximately ten years or lugged back one year (by means of a modified return). Keeping exact documents of foreign earnings and tax obligations paid is consequently crucial to calculating the appropriate FTC and keeping tax compliance.

expatriates to minimize their tax obligation responsibilities. As an example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can exclude approximately $130,000 making use of the FEIE (2025 ). The continuing to be $120,000 might then undergo tax, but the U.S. taxpayer can possibly use the Foreign Tax obligation Credit scores to offset the tax obligations paid to the foreign country.

Some Known Facts About Feie Calculator.

He sold his United state home to develop his intent to live abroad permanently and used for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Examination. Neil directs out that getting building abroad can be testing without first experiencing the location.

"We'll certainly be outdoors of that. Also if we return to the US for physician's appointments or service phone calls, I doubt we'll spend more than 30 days in the US in any kind of provided 12-month period." Neil highlights the importance of rigorous tracking of united state check outs. "It's something that people require to be really persistent concerning," he states, and advises deportees to be cautious of common blunders, such as overstaying in the united state

Neil bewares to tension to U.S. tax obligation authorities that "I'm not performing any kind of business in Illinois. It's simply a mailing address." Lewis Chessis is a tax consultant on the Harness system with extensive experience helping U.S. residents browse the often-confusing realm of global tax obligation compliance. One of one of the most typical false impressions among U.S.

Some Of Feie Calculator

tax obligation return. "The Foreign Tax Credit history permits individuals operating in high-tax nations like the UK to offset their united state tax obligation liability by the quantity they've already paid in taxes abroad," claims Lewis. This makes sure that expats are not taxed twice on the exact same revenue. Those in reduced- or no-tax nations, such as the UAE or Singapore, face additional difficulties.

The prospect of lower living costs can be tempting, however it frequently comes with trade-offs that aren't right away noticeable - https://allmy.bio/feiecalcu. Housing, for instance, can be more cost effective in some nations, yet this can suggest jeopardizing on framework, safety and security, or access to reputable energies and solutions. Low-cost residential or commercial properties may be located in locations with irregular net, restricted mass transit, or unstable medical care facilitiesfactors that can significantly affect your daily life

Below are several of one of the most often asked questions regarding the FEIE and other exclusions The International Earned Earnings Exclusion (FEIE) permits united state taxpayers to exclude approximately $130,000 of foreign-earned income from government earnings tax, minimizing their united state tax obligation liability. To get approved for FEIE, you should satisfy either the Physical Presence Examination (330 days abroad) or the Authentic Residence Examination (verify your main residence in a foreign country for an entire tax obligation year).

The Physical Presence Test also needs U.S. taxpayers to have both a foreign income and a foreign tax obligation home.

More About Feie Calculator

An income tax treaty in between the united state and another nation can assist protect against double taxes. While the Foreign Earned Earnings Exemption reduces taxed earnings, a treaty may provide extra advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declare U.S. citizens with over $10,000 in foreign economic accounts.

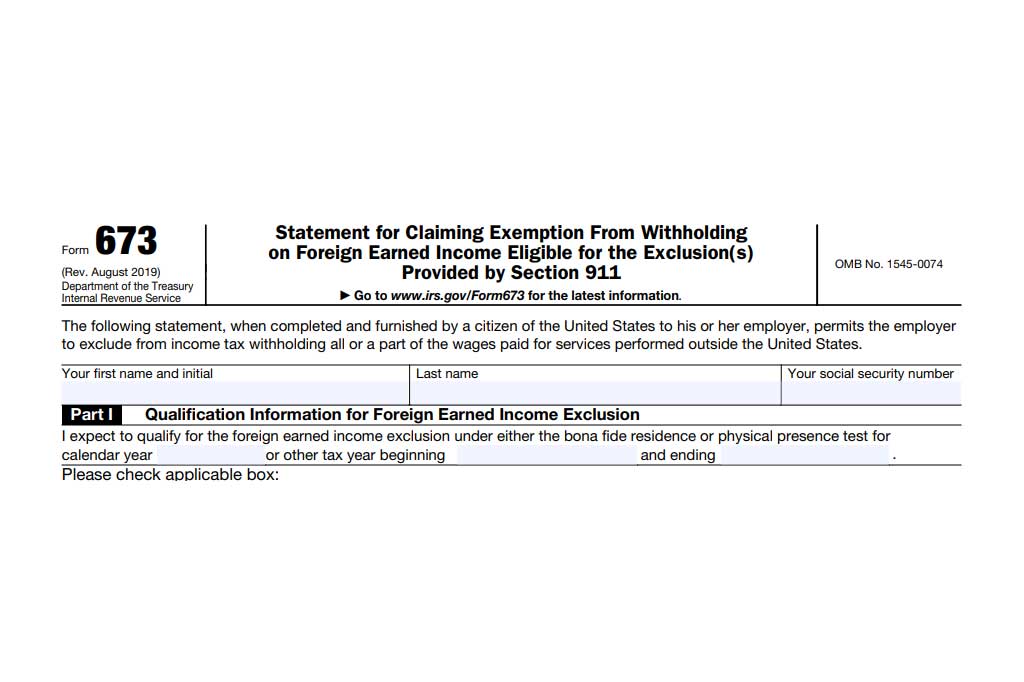

The international earned income exclusions, occasionally referred to as the Sec. 911 exclusions, leave out tax on earnings made from working abroad. The exclusions consist of 2 components - an income exclusion and a real estate exemption. The adhering to FAQs review the advantage of the exemptions consisting of when both spouses are expats in a basic fashion.

How Feie Calculator can Save You Time, Stress, and Money.

The tax obligation advantage excludes the income from tax obligation at bottom tax prices. Previously, the exclusions "came off the top" reducing earnings topic to tax obligation at the top tax obligation rates.

These exemptions do not spare the salaries from United States tax yet merely provide a tax decrease. Keep in mind that a single individual functioning abroad for all of 2025 who gained concerning $145,000 with no other income will have gross income minimized to no - efficiently the same answer as being "free of tax." The exemptions are computed on a day-to-day basis.

If you went to company meetings or workshops in the US while living abroad, earnings for those days can not be excluded. For US tax obligation it does not matter where you maintain your funds - you are taxed on your around the world earnings as an US person.